Calculation ROI Home Office vs. Luxury Home including travel

Calculating the Return on Investment (ROI) for a home office compared to a luxury house in Thailand requires considering several factors, including property appreciation, rental income potential, tax benefits, and any associated costs. Here’s a step-by-step guide:

1. Initial Investment

- Luxury Home Office: Consider the total cost of purchasing and setting up the home office, including any renovations or additions specific to business use.

- Luxury House: Consider the total cost of purchasing the luxury home, including any interior design or landscaping costs.

2. Potential Revenue Streams

- Home Office:

- Business Income: If you operate a business from the home office, the revenue generated can be considered part of the ROI.

- Rental Income: If you decide to rent out the office space or part of the property, this income adds to the ROI.

- Luxury House:

- Rental Income: If you rent out the property or part of it (like a guest house), the rental income contributes to the ROI.

3. Property Appreciation

- Market Growth: Both the home office and luxury house can appreciate over time, depending on location, market trends, and property upkeep.

- Commercial Zoning Impact: Properties that can be used commercially (like a home office) may appreciate more in value compared to purely residential properties, especially in areas with high business activity.

4. Tax Considerations

- Property Taxes:

- In Thailand, property taxes are generally the same for both residential and commercial properties. However, commercial properties might face higher tax rates depending on the area and local regulations.

- Business Expenses:

- Home Office: Certain expenses, such as utilities, maintenance, and depreciation related to the office portion of the property, can be tax-deductible if you register the business at that location.

- Luxury House: If used solely as a residence, fewer tax deductions are available. However, if part of the home is rented out or used for business, some deductions might apply.

5. Operating Costs

- Home Office: Consider costs like utilities, maintenance, and any business-related expenses. If the property has energy-efficient features (e.g., solar panels), these can reduce ongoing costs and improve ROI.

- Luxury House: Operating costs are generally focused on maintenance, utilities, and lifestyle-related expenses, with fewer opportunities for tax deductions.

6. Exit Strategy

- Home Office: If you sell the property, the resale value can be influenced by its dual-purpose nature. The commercial aspect might make it more attractive to buyers who need a combined living and working space.

- Luxury House: Resale value will depend on the property’s location, condition, and the general real estate market for luxury homes.

ROI Calculation Formula

The basic ROI formula is:

Where:

- Net Profit = (Potential Revenue + Property Appreciation) – (Operating Costs + Taxes + Initial Investment)

- Total Investment = Initial Purchase Cost + Any Additional Costs (Renovations, Upgrades, etc.)

Example Calculation for a Home Office @30 Million Bt/unit

1. Initial Investment:

- Purchase Price: 30 million THB

- Renovation for Office Use: 1 million THB

- Total: 31 million THB

2. Potential Revenue:

- Business Income: 2 million THB/year

- Property Appreciation: 5% annual appreciation = 1.55 million THB/year

- Total: 3.55 million THB/year

3. Operating Costs:

- Utilities, Maintenance, and Taxes: 0.5 million THB/year

- Net Profit (Yearly): 3.05 million THB

4. ROI:

Example Calculation for a Luxury House

1. Initial Investment:

- Purchase Price: 30 million THB

- Renovation: 1 million THB

- Total: 31 million THB

2. Potential Revenue:

- Rental Income: 1 million THB/year

- Property Appreciation: 5% annual appreciation = 1.55 million THB/year

- Total: 2.55 million THB/year

3. Operating Costs:

- Utilities, Maintenance, and Taxes: 0.5 million THB/year

- Net Profit (Yearly): 2.05 million THB

4. ROI:

Key Points

- The home office generally offers a higher ROI due to additional income streams and potential tax benefits.

- The luxury house might have a lower ROI due to fewer income opportunities, but it could still be a sound investment if the property appreciates significantly.

Legal Considerations in Thailand

- Zoning Laws: Ensure the property is zoned for commercial use if you plan to run a business. This can impact both ROI and legal compliance.

- Tax Laws: Consult with a tax advisor familiar with Thai property and business laws to maximize deductions and ensure compliance with local regulations.

Conclusion

When comparing the ROI of a home office versus a luxury house in Thailand, the home office often presents a more lucrative investment due to its potential for multiple revenue streams, tax benefits, and appreciation in value, especially when located in a commercially viable area like Sukhumvit-Praekasa.

Example Calculation for a Home Office @16.5 Million Bt/unit

Property price: 16.5 million THB

- Loan (Mortgage): 95% of property value

- Interest rate: 6.5% per year

- Loan term: 25 years

We will calculate the monthly mortgage payment using the formula for fixed-rate mortgage payments:

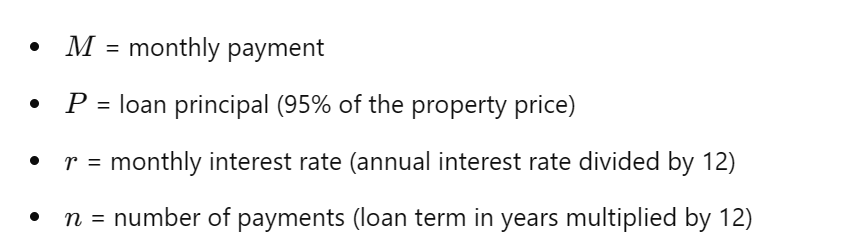

Where:

Step 1: Calculate Loan Principal

- Property price: 16,500,000 THB

- Loan amount (95%):

P = 16,500,000 x 95% = 15,675,000 THB

Step 2: Convert Annual Interest Rate to Monthly

- Annual interest rate: 6.5%

- Monthly interest rate:

r = 6.5%/ 12 = 0.065/12 = 0.00541667

Step 3: Calculate the Number of Payments

- Loan term: 25 years

- Total number of payments:

n = 25 x 12 = 300 months

Step 4: Calculate Monthly Mortgage Payment

Using the formula for the monthly mortgage payment:

M = 15,675,000 x (0.00541667(1 + 0.00541667)^300) / (1 + 0.00541667)^300 – 1)

Let me calculate this for you.

The monthly mortgage payment for a 16.5 million THB property with a 95% loan (15.675 million THB), a 6.5% interest rate, and a 25-year term is approximately 105,839 THB per month.

Comparison Between Home Office and Luxury House:

For both the home office and the luxury house, the monthly mortgage payment is the same at 105,839 THB, since the loan terms and property prices are identical.

However, the key difference will be the net expenses due to the tax savings from the home office, as outlined earlier. Let’s incorporate these into the monthly comparison.

Step 5: Net Expenses Comparison (Including Tax Savings)

Home Office Scenario (50% area for business use):

- Tax savings: 142,500 THB/year (calculated earlier)

- Tax savings per month:

142,500 THB/ 12 = 11,875 THB/month - Net monthly payment for Home Office:

105,839 THB – 11,875 THB = 93,964 THB/month

Luxury Home Scenario:

- No tax savings

- Net monthly payment for Luxury Home:

105,839 THB/month

Summary of Monthly Payments:

- Home Office: 93,964 THB/month (after tax savings)

- Luxury Home: 105,839 THB/month

Conclusion:

Buying a home office results in net monthly savings of 11,875 THB compared to a luxury home, thanks to tax deductions available for business-related expenses.

To compare the total costs of owning a home office (with tax savings) versus renting an office space and owning a luxury home, we will include the rental expenses for the office in the second scenario.

Assumptions:

- Office rental area: 100 sqm

- Rental rate: 350 THB/sqm

- Monthly rental cost: 100 sqm × 350 THB/sqm = 35,000 THB/month

- The same mortgage conditions apply to the luxury home.

Scenario 1: Home Office (100 sqm as Office, 50% of total space for business use)

Mortgage Payment for Home Office:

As calculated earlier, the monthly mortgage payment is 105,839 THB/month.

Tax Savings:

- With 50% of the home used for business purposes, annual tax savings are 142,500 THB/year, or 11,875 THB/month.

Net Monthly Payment for Home Office:

Net Payment= 105,839 THB − 11,875 THB = 93,964 THB/month

Scenario 2: Renting Office + Owning a Luxury Home

Mortgage Payment for Luxury Home:

For a luxury home, the monthly mortgage payment is the same, 105,839 THB/month.

Office Rental:

- Monthly rental cost for 100 sqm at 350 THB/sqm = 35,000 THB/month.

Total Monthly Cost for Renting Office + Owning Luxury Home:

Total Monthly Cost = 105,839 THB + 35,000 THB = 140,839 THB/month

Comparison of Total Monthly Costs:

- Home Office:

Total Monthly Cost = 93,964 THB/month - Renting Office + Luxury Home:

Total Monthly Cost = 140,839 THB/month

Summary of Monthly Savings:

- Home Office saves 46,875 THB/month compared to renting an office and owning a luxury home.

Conclusion:

If you use 100 sqm of your home office space for business purposes, you can save 46,875 THB/month by owning a home office compared to renting an office and owning a luxury home. The cost of renting an office combined with the luxury home mortgage significantly increases your overall expenses, making the home office a much more cost-effective solution for those running a business.

Assumptions for Travel Costs:

- Distance: 30 minutes one way (about 20-25 km per day, depending on traffic and route)

- Fuel cost: 40 THB/liter

- Fuel efficiency: 10 km/liter (standard for many cars)

- Number of trips: 5 days a week (20 days per month)

- Parking cost: 50 THB/day

- Other car-related costs: maintenance, depreciation, insurance, etc. (factored into a rough estimate of about 2,000 THB/month)

1. Calculate Monthly Fuel Cost:

- Distance per day: 50 km (round trip)

- Total distance per month:

50 km/day x 20 days/month = 1,000 km/month - Fuel consumption per month:

1,000 km/ 10 km/l = 100 liters/month - Fuel cost per month:

100 liters/month x 40 THB/liter = 4,000 THB/month

2. Parking Cost:

- Parking cost per day: 50 THB

- Parking cost per month:

50 THB/day x 20 days/month = 1,000 THB/month

3. Maintenance and Other Costs:

- Estimated cost for car maintenance, insurance, and depreciation: 2,000 THB/month

Total Monthly Travel Cost:

Total Travel Cost = 4,000 THB (fuel) + 1,000 THB (parking) + 2,000 THB (maintenance) = 7,000 THB/month

Revised Comparison:

Scenario 1: Home Office (50% used for business):

- Net monthly payment (after tax savings): 93,964 THB/month

- No travel costs, as the office is at home.

Scenario 2: Renting Office + Luxury Home:

- Total monthly mortgage and rent: 140,839 THB/month

- Additional travel cost: 7,000 THB/month

Total Monthly Cost for Renting Office + Luxury Home (with travel):

140,839 THB/month + 7,000 THB/month = 147,839 THB/month

Final Comparison of Total Costs:

- Home Office: 93,964 THB/month (no travel costs)

- Renting Office + Luxury Home (with travel): 147,839 THB/month

Total Savings from Home Office:

147,839 THB – 93,964 THB = 53,875 THB/month

Conclusion:

Owning a home office provides monthly savings of 53,875 THB compared to renting an office and living in a luxury home when factoring in travel expenses. This further reinforces the cost-efficiency of purchasing a home office for those running a business compared to renting separate office space.